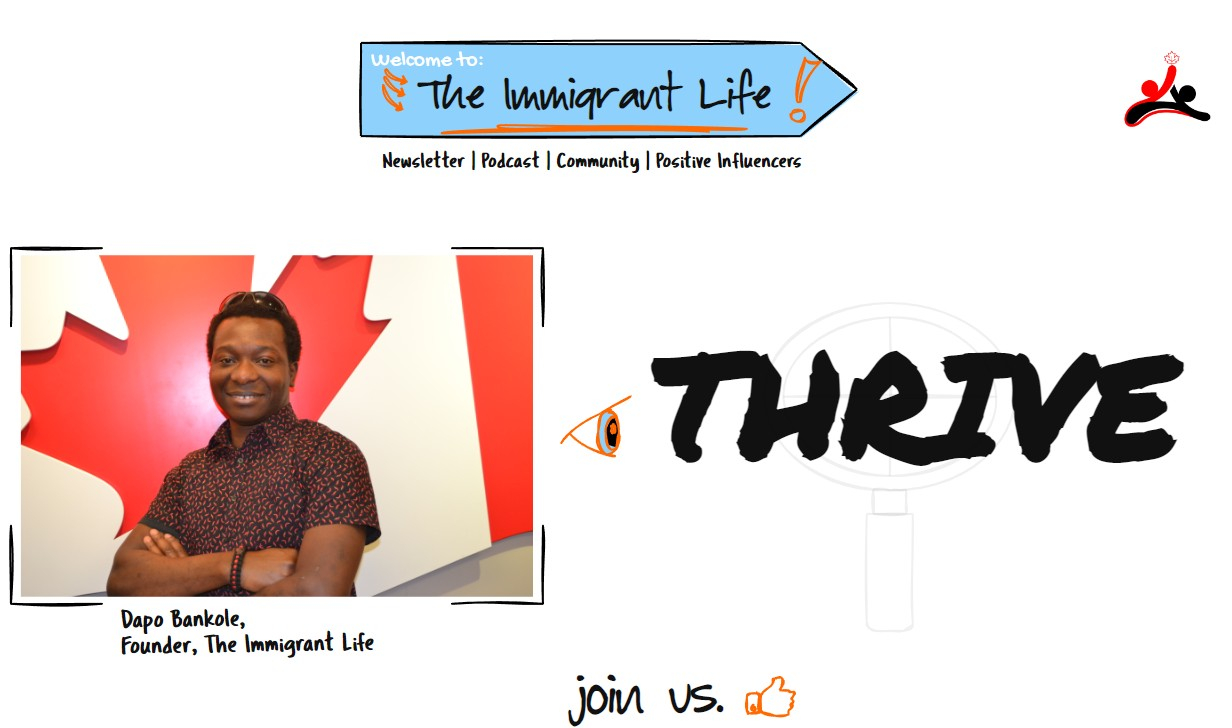

The Immigrant Life

On The Immigrant Life, get the lessons learned, tips, strategies, actionable insights & resources that will help you thrive as a first-generation Canadian immigrant.

By registering you agree to Substack's Terms of Service, our Privacy Policy, and our Information Collection Notice